The bureau has issued Revenue Memorandum Circular (RMC) No. 69-2023 to inform the taxpayers, public and all concerned about the reversion of Rates of Percentage Tax, Minimum Corporate Income Tax, and Regular Corporate Income Tax on Proprietary Hospitals, in relation with Republic Act No. 11534, otherwise known as the "Corporate Recovery and Tax Incentives for Enterprises Act" (CREATE).

This article focus on the Reversion of Rate of Percentage Tax from One Percent (1%) to three percent (3%) Effective July 01, 2023 as stated in RMC No. 69-2023 dated June 20, 2023 with details as follows:

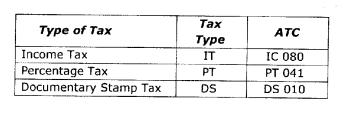

1. The rate of percentage tax (PT) shall now revert to three percent (3%) of gross quarterly sales or receipts of the taxpayer. This rate applies to corporations, self-employed individuals and professionals whose gross sales or gross receipts are not exceeding Php3.0 million threshold, except for cooperatives and self-employed individuals and professionals availing of the eight percent (8) income tax rate.

To read the full text of the circular, please refer to RMC No. 69-2023.